In the competitive world of investment management, launching a fund is only the beginning of a much longer journey. For sustained success, you need a comprehensive fund lifecycle management approach—covering every aspect from fund structuring and licensing to administration, compliance oversight, investor relations, and ultimately, fund closure or restructuring. Partnering with one of the best fund lifecycle management providers ensures that your investment vehicle operates efficiently, complies with all relevant regulations, and delivers strong, consistent results for its investors.

At FundSetup, we provide end-to-end fund lifecycle management solutions that are tailored to the unique needs of hedge funds, private equity funds, venture capital funds, and other specialized investment structures. Our expertise allows fund managers to focus on what they do best—generating returns—while we handle the operational, regulatory, and administrative complexities of fund management.

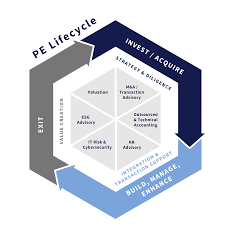

Understanding the Fund Lifecycle

The fund lifecycle comprises several interconnected phases, each demanding specialized knowledge and precise execution:

1. Fund Structuring & Formation

This is the foundation of any investment vehicle. We help establish tax-efficient, compliant structures that align with both investor objectives and the fund’s investment strategy. Whether it’s a master-feeder structure, an umbrella fund, or a bespoke vehicle, our goal is to create a robust framework that supports long-term success.

2. Regulatory Licensing & Approval

Before a fund can operate, it must secure the appropriate licenses and approvals from relevant financial authorities. We manage the entire process—from preparing documentation to liaising with regulators—ensuring a smooth and timely launch.

3. Fund Administration

Ongoing administration is essential to a fund’s success. This includes NAV calculations, accounting, investor reporting, and capital flow management. We use advanced systems to ensure accuracy, timeliness, and transparency at every stage.

4. Investor Relations

Investors expect clear, transparent, and regular communication. We handle onboarding, KYC/AML verification, subscription and redemption processing, and provide timely performance and financial updates to maintain investor confidence.

5. Compliance Oversight

In a global regulatory environment, compliance is non-negotiable. We ensure full adherence to AML/KYC, FATCA, CRS, and jurisdiction-specific rules, providing proactive updates as regulations evolve.

6. Restructuring or Closure

Over time, a fund’s strategy may change, or it may need to wind down operations. We guide managers through fund restructuring, mergers, or orderly closures, always prioritizing investor protection and regulatory compliance.

Why Top Fund Lifecycle Management Providers Stand Out

The best providers go beyond administrative services—they become strategic partners who enhance fund efficiency and investor trust. Key advantages include:

-

Jurisdictional Expertise – In-depth knowledge of leading fund domiciles such as Cayman Islands, Luxembourg, ADGM, DIFC, BVI, and Mauritius.

-

Operational Excellence – Streamlined processes that reduce delays and operational expenses.

-

Technology-Driven Solutions – Real-time access to performance reports and investor data through secure digital platforms.

-

Compliance Assurance – Proactive risk management to prevent legal and regulatory issues before they arise.

FundSetup’s End-to-End Solutions

We provide comprehensive coverage for every stage of the fund lifecycle:

1. Fund Structuring & Legal Documentation

We create tailored structures for hedge funds, private equity, venture capital, and other investment vehicles, ensuring legal compliance and tax optimization.

2. Jurisdiction Selection

Our team helps identify the best domicile for your fund based on tax advantages, investor profile, and regulatory environment.

3. Licensing & Filings

We manage all licensing and registration requirements in both onshore and offshore jurisdictions, ensuring a smooth approval process.

4. Administration & Accounting

We handle NAV calculations, investor statements, capital calls, and expense tracking, using secure platforms for data protection and transparency.

5. Compliance Management

Our compliance specialists conduct full AML/KYC checks, ensure FATCA/CRS reporting, and monitor evolving global regulations.

6. Investor Communication

We deliver accurate, timely reports and updates, strengthening relationships and increasing investor satisfaction.

Global Reach, Local Expertise

Our capabilities extend across multiple jurisdictions, allowing us to cater to diverse investment strategies:

-

Cayman Islands – Global leader for hedge funds and private equity structures.

-

Luxembourg – Home to UCITS and alternative investment funds.

-

ADGM & DIFC (UAE) – Strategic hubs for cross-border investment management.

-

BVI & Mauritius – Flexible, tax-efficient fund domiciles for emerging market investments.

Advantages of Partnering with FundSetup

-

One-Stop Service – From formation to closure, we handle every stage.

-

Customized Strategies – Each solution is tailored to your specific investment goals.

-

Speed & Efficiency – Accelerated fund launches without compliance risks.

-

Investor Confidence – Transparent governance to attract and retain capital.

The Future of Fund Lifecycle Management

The investment management industry is undergoing significant transformation with the adoption of AI-driven analytics, blockchain-based reporting, and ESG compliance frameworks. At FundSetup, we are committed to integrating these innovations into our services, ensuring that our clients remain at the forefront of the market.

By combining global reach with local expertise, technology with human insight, and efficiency with compliance, we deliver fund lifecycle management solutions that enable managers to navigate complexity with confidence.

If you are searching for the best fund lifecycle management provider, FundSetup offers the operational strength, compliance assurance, and strategic vision to guide your fund from inception to long-term success.

📍 Location: Dubai, UAE

📧 Email: info@fundsetup.net

📞 Contact: +971 52 888 1249