What Are Printable Checks for QuickBooks and How Do They Work?

Managing payments is one of the most important tasks in any business. Whether you’re paying vendors, employees, or service providers, you need a method that’s reliable, accurate, and easy to track. QuickBooks has made this easier with its check-printing feature. But what exactly are printable checks for QuickBooks, and how do they work?

Let’s explore this concept simply and practically.

Understanding Printable Checks for QuickBooks

Printable checks for QuickBooks are physical checks you print directly from your QuickBooks software instead of writing them by hand. These checks are used for business transactions like paying bills, salaries, or contractors.

Unlike handwritten checks, which can be prone to mistakes or hard to track, these printed checks come straight from your accounting system. This means your payment details are stored, organized, and easy to refer to later.

Think of it as combining the convenience of digital records with the security and familiarity of paper checks.

Why Businesses Use Printable Checks

There are several reasons why businesses prefer printable checks for QuickBooks over traditional checks:

1. Saves Time

Manually writing out checks is slow. It involves copying details from invoices or spreadsheets, double-checking amounts, and making sure everything is correct. QuickBooks simplifies this. Once your bills are entered, you just select the check, click print, and you’re done.

2. Reduces Errors

Because the information comes directly from your accounting records, there’s less room for mistakes. The software pulls data like the payee name, amount, and date from your saved entries.

3. Keeps Records Organized

Every time you print a check, QuickBooks automatically records the transaction. You don’t need to enter it again. This makes reconciliation easier and saves time during audits or tax season.

4. Looks Professional

Printed checks look clean and professional. You can add your business logo, change the layout, and ensure every check has the same format. This builds trust with vendors and clients.

What Do You Need to Print Checks in QuickBooks?

Printing checks from QuickBooks doesn’t require a complicated setup. Here’s what you typically need:

– A Computer with QuickBooks Installed

You can use either the desktop or online version, depending on your business setup.

– Printable Checks Compatible with QuickBooks

These are special blank check papers designed to work with the software. They have sections for the date, amount, signature, and account details in the correct layout.

– A Printer

An ordinary inkjet or laser printer works just fine. There’s no need for a special machine.

Once you have these, you’re ready to go.

How Do Printable Checks for QuickBooks Work?

Let’s walk through the basic steps of how it all works, from entering a payment to printing the check:

Step 1: Enter Your Payment in QuickBooks

Start by recording the payment. This could be a bill you’re paying or a contractor you owe money to. You’ll fill out the details like:

- Payee name

- Amount

- Date

- Purpose of payment

This information is saved in your QuickBooks records.

Step 2: Choose to Print a Check

Next, you select the option to pay by check. QuickBooks will ask if you want to print the check now or later. Choose the appropriate option based on your needs.

Step 3: Insert the Printable Check Paper

Load the blank check paper into your printer. Make sure it’s aligned correctly. Some check papers have one check per sheet, while others may have two or three.

Step 4: Print the Check

Click the print button in QuickBooks. The software will format the information and print it onto the check paper. This includes:

- The check number

- Your company name and address

- The payee name

- The amount (in numbers and words)

- The date

- A memo (optional)

- A signature line

Step 5: Sign and Send

After printing, sign the check manually. Then you can either mail it or hand it over, just like any regular check.

QuickBooks automatically records this payment in your ledger. So when you check your reports or balance sheet, the transaction is already included.

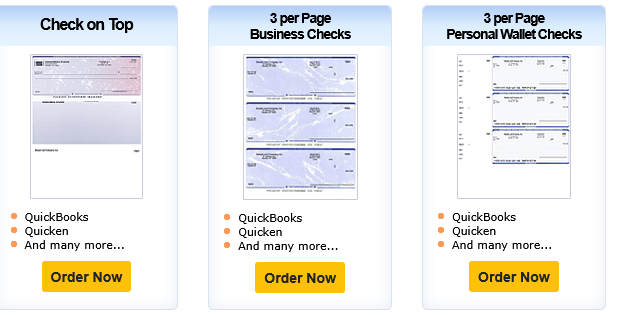

Different Check Formats Supported by QuickBooks

When using printable checks for QuickBooks, you’ll notice there are a few layout options. These are based on how many checks appear on a single page.

1. Voucher Checks

This is the most common format. It prints one check per page, with a stub above and below the check. The stubs show payment details, which you can keep for your records or send along with the check.

2. Standard Checks

These print three checks per page, without stubs. They’re great if you print a high volume of checks and don’t need the extra details on each one.

3. Wallet Checks

These are smaller and look more like personal checks. They’re not often used in business settings, but they are still supported.

When ordering or choosing check paper, make sure you pick the format that matches your printing needs and your QuickBooks settings.

Benefits of Using Printable Checks for QuickBooks

Let’s take a closer look at why these checks are so popular:

- Consistency: Every check is uniform, making record-keeping easier.

- Audit Trail: You can easily trace when and why a payment was made.

- Security: Many check papers include features like watermarks and microprint lines for added protection.

- Flexibility: You can edit or reprint if there’s a mistake (before signing, of course).

- Accessibility: Anyone familiar with QuickBooks can quickly learn how to print checks.

Common Questions About Printable Checks

Can I Reuse Check Paper if I Mess Up?

It’s not recommended. If the printer jams or prints incorrectly, void the check and start fresh. This helps keep your records clean and avoids confusion.

Do I Need Special Ink?

No. Regular ink works fine. Just make sure your printer prints clearly and that the MICR line (the series of numbers at the bottom) is readable if needed by your bank.

What Happens If I Run Out of Checks?

QuickBooks will still allow you to record payments, but you won’t be able to print checks until you restock your blank check paper.

Conclusion

Printable checks for QuickBooks offer a smart solution for businesses that still rely on paper payments but want the speed and accuracy of modern accounting tools. They save time, reduce errors, and help you stay organized.

Whether you’re a small business owner managing a few payments a month or an accountant handling bulk check runs, this method can streamline your workflow without adding stress.

With the right setup and a bit of practice, printing checks from QuickBooks can become one of the simplest parts of your financial routine.