The cryptocurrency marketplace, let’s be real, is a dynamic and frequently bewildering surroundings. It’s like navigating a fast-shifting, uneven sea without a compass, where currents can shift route in and on the spot. For the disciplined investor, however, the chaos regularly contains hidden alerts, insights that could rework volatility into opportunity. These alerts are etched directly onto charge charts, forming awesome crypto chart patterns that, while understood, can become the maximum reliable equipment in an investor’s arsenal. Mastering this visible language isn’t approximately predicting the future with absolute reality, but alternatively about enhancing the possibility of favorable consequences and coping with risk correctly in a landscape in which sentiment often runs high.

Decoding the Market’s Whisper

At its center, technical evaluation, and in particular the look at crypto chart patterns, is the practice of inspecting past rate action to forecast capability destiny moves. These patterns are not arbitrary; they are visible representations of the ordinary psychology of marketplace contributors – the ebb and flow of worry and greed, optimism and pessimism. Recognizing those formations permits investors to assume capability reversals or continuations of traits, presenting clearer access and exit factors. It’s about getting to know the collective behavior of tens of millions of investors condensed into a chain of traces and candles.

Foundational Patterns Every Investor Should Know

Understanding a middle set of chart styles is critical for any extreme crypto investor. These patterns can be widely categorized into reversal patterns, which sign a potential alternate in trend route, and continuation patterns, which advocate a brief pause before the present trend resumes. Each pattern includes its own particular implications and chances.

Reversal Patterns: Signaling a Shift in Momentum

Reversal patterns frequently seem at market turning factors, indicating that the winning fashion is losing momentum and a new one may additionally begin. A conventional example is the “Head and Shoulders” sample, often seen at marketplace tops, characterized via three peaks, with the center height (the “head”) better than the two surrounding peaks (the “shoulders”), all resting on a commonplace “neckline.” A spoil underneath this neckline, mainly on increasing volume, generally signals a bearish reversal. Conversely, the “Inverse Head and Shoulders” is its bullish counterpart, acting at marketplace bottoms and suggesting an upward reversal. Another commonplace reversal formation is the “Double Top” or “Double Bottom,” forming an ‘M’ or ‘W’ form respectively, indicating two failed attempts to interrupt a key resistance or assist stage before reversing. These patterns are effective due to the fact they encapsulate an essential shift in buying or promoting stress.

Continuation Patterns: Confirming the Trend

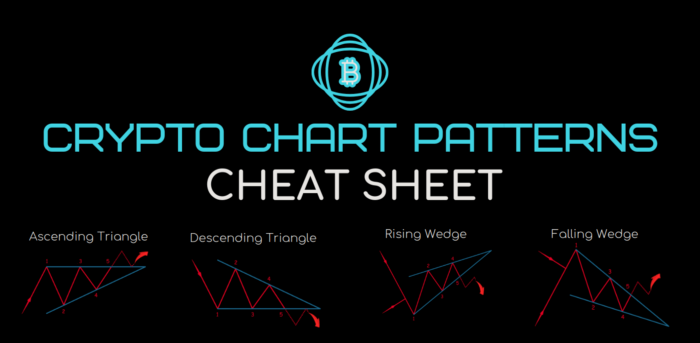

Continuation styles, on the other hand, recommend that a short length of consolidation or pause is taking place earlier than the hooked up trend maintains. Examples consist of “Flags” and “Pennants,” that are commonly small, quick-time period patterns forming after a sharp charge circulate, indicating a breather earlier than the fashion resumes in the equal course. “Triangles,” including “Ascending,” “Descending,” or “Symmetrical” triangles, additionally fall into this class. An Ascending Triangle, as an instance, features a flat resistance line and a rising assist line, frequently preceding a bullish breakout. These styles provide opportunities to enroll in a current fashion after a transient pullback, often supplying a clearer threat-praise setup for those looking to capitalize on established momentum.

Volume and Indicators: The Unseen Confirmation

While figuring out crypto chart patterns is important, depending entirely on them can be an unstable proposition. The real electricity of technical analysis lies in confirming those styles with other data points, by and large trading volume and key technical indicators. Volume, the sheer range of assets traded, acts as the marketplace’s conviction meter. A pattern breaking out to a high extent shows strong conviction at the back of the flow, growing its reliability. Conversely, a breakout on low quantity might suggest a “fakeout” or a move missing genuine market help.

Beyond volume, momentum oscillators like the Relative Strength Index (RSI) and fashion-following signs just like the Moving Average Convergence Divergence (MACD) provide additional layers of confirmation. The RSI can signal overbought or oversold conditions, indicating when an asset might be due for a reversal or jump, even as the MACD facilitates to confirm trend power and capability shifts in momentum via its crossovers. For instance, when analyzing the ability volatility in a GameFi token, a strong breakout inside the Gala coin charge after forming a bullish chart sample could benefit good sized credibility if followed with the aid of a surge in buying and selling volume and a bullish crossover on the MACD, indicating sturdy buying interest and a showed fashion.

The Human Element: Psychology Behind the Patterns

It’s crucial to take into account that crypto chart patterns are not magical prophecies; they’re reflections of collective human psychology gambling out within the marketplace. The routine shapes represent the regular behavior of traders reacting to worry, greed, wish, and depression. A head and shoulders pattern, for example, suggests an initial surge of optimism, observed through an excellent greater surge (the pinnacle), then a diminishing enthusiasm (the second shoulder) as shopping for strength wanes and dealers manipulate.

Understanding this underlying psychology adds intensity to chart analysis. It lets in the disciplined investor to no longer best pick out a pattern however additionally to grasp why that sample is forming. In the fast-paced, regularly irrational international of crypto, wherein social media narratives can extend sentiment instantly, recognizing those deeply ingrained behavioral dynamics is a great gain. It enables distinguishing among real shifts in market conviction and transient FUD (Fear, Uncertainty, Doubt) or FOMO (Fear of Missing Out).

Applying Chart Wisdom in a Volatile World

Applying chart wisdom within the volatile crypto marketplace, mainly in hastily evolving sectors like GameFi or decentralized finance, calls for a pragmatic and disciplined method. No sample ensures a selected final result, but they significantly enhance the percentages. The key’s to appoint sound chance control concepts. This consists of setting clean forestall-loss tiers to restrict ability losses if a sample fails, and defining sensible earnings objectives based totally on the sample’s implied circulate.

The concept of “confluence” is likewise important: while multiple technical alerts or patterns align, the probability of the forecasted move will increase dramatically. For instance, if a “Falling Wedge” sample (regularly bullish) forms at a robust historical guide level, and the RSI shows oversold situations, the possibility of a jump strengthens considerably. As we examine markets in mid-2025, with new narratives around tokenized actual-global belongings and AI-driven DeFi emerging, these middle analytical capabilities emerge as even more critical. While a simple observation of the Gala coin price would possibly tempt impulsive decisions, a disciplined technique, integrating chart analysis with broader marketplace know-how and hazard management, stays the foundation for sustained fulfillment.

Conclusion

The ability to study and interpret crypto chart styles is an invaluable skill for anyone navigating the complex, regularly chaotic waters of the virtual asset marketplace. These visible formations, rooted in collective human psychology, offer profound insights into potential market moves, offering a framework for watching for reversals or continuations. While no tool offers infallible predictions, getting to know this language of charts, combined with rigorous threat control and a knowledge of broader marketplace fundamentals, appreciably complements an investor’s capability to spot opportunities and defend capital. Discipline and a continuous commitment to studying are the true north stars on this ever-evolving economic frontier.