Lidocaine Market: Outlook, Drivers, and Strategic Insights

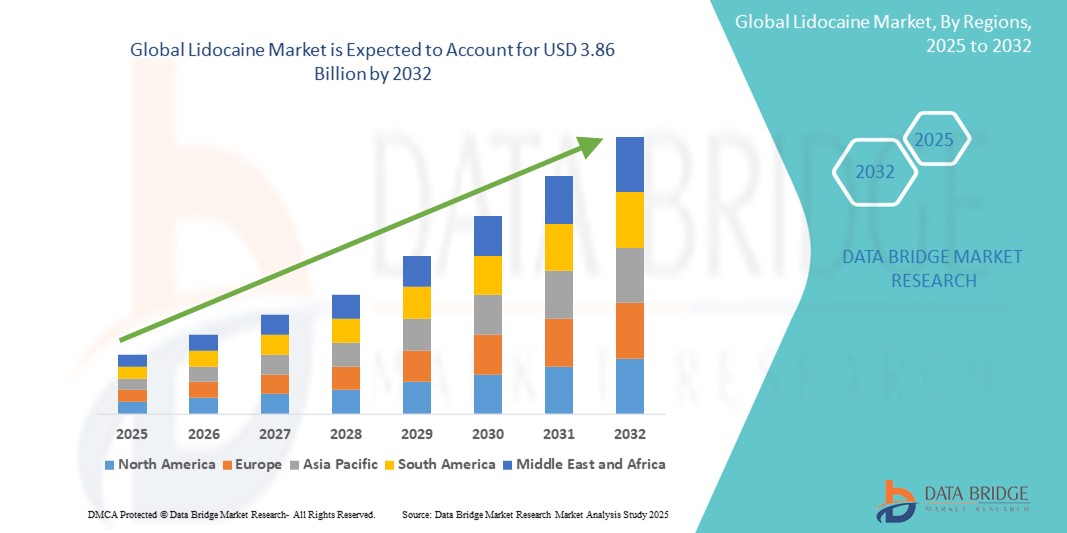

The global lidocaine market size was valued at USD 2.55 billion in 2024 and is expected to reach USD 3.86 billion by 2032, at a CAGR of 5.30% during the forecast period

Introduction

Lidocaine (also known as lignocaine) is an amide-type local anesthetic and class Ib antiarrhythmic widely used across hospital, ambulatory, and dental settings. Its rapid onset, intermediate duration, and favorable safety profile have made it a staple for local infiltration, nerve blocks, topical anesthesia, and certain cardiac indications. Beyond traditional injections, lidocaine powers a broad portfolio of dosage forms—topical gels, creams, sprays, patches, viscous oral solutions, ophthalmic preparations, and combination products—positioning it at the intersection of anesthesia, pain management, dermatology, and procedural medicine. The market benefits from sustained procedural volumes, expanding minimally invasive care, and rising demand for non-opioid analgesia.

Source – https://www.databridgemarketresearch.com/reports/global-lidocaine-market

Market Overview

The global lidocaine market encompasses active pharmaceutical ingredient (API) production and finished dosage formulations supplied to hospitals, clinics, dental practices, ambulatory surgical centers, and retail/online pharmacies. Demand is diversified: routine minor surgeries and laceration repairs, dental procedures, cosmetic dermatology (laser resurfacing, fillers), musculoskeletal injections, wound care, and neuropathic pain management via transdermal systems. Additionally, lidocaine’s role as an antiarrhythmic (intravenous formulations) contributes to critical-care demand, though volumes are smaller than anesthesia indications.

Multiple manufacturers compete in a largely generics-driven environment, with differentiation arising from quality systems, supply reliability, ready-to-use presentations, preservative-free options, and advanced delivery formats such as patches and sustained-release injectables. Periodic supply disruptions and price volatility underscore the importance of dual-sourcing and quality compliance.

Key Growth Drivers

-

Shift to Ambulatory and Office-Based Procedures

Growth in dermatology, dentistry, and minor surgical procedures outside the inpatient setting increases use of local anesthesia, topical analgesics, and pre-filled syringes that streamline workflow. -

Preference for Non-Opioid Analgesia

Clinical and policy emphasis on opioid-sparing strategies supports expanded use of local anesthetics before, during, and after procedures, as well as in chronic pain adjunct therapy. -

Cosmetic and Aesthetic Medicine

Rising volumes of minimally invasive aesthetic procedures (e.g., injectables, microneedling, laser therapies) fuel demand for topical and infiltrative lidocaine, including compounded blends with epinephrine or tetracaine where permitted. -

Technology and Formulation Innovation

Growth in transdermal patches, liposomal/encapsulated forms, and buffered or alkalinized solutions improve patient comfort, onset time, and duration, expanding clinical utility and supporting premium pricing. -

Aging Population and Chronic Conditions

Greater prevalence of neuropathic pain and musculoskeletal disorders in older adults increases demand for topical patches and gels that offer localized relief with minimal systemic exposure.

Market Restraints

-

Safety and Dosing Limits: Narrow margins in certain patient groups (pediatrics, hepatic impairment) and risk of local anesthetic systemic toxicity require careful dosing and monitoring, limiting aggressive uptake in some settings.

-

Generic Competition and Price Pressure: Intense competition compresses margins for commodity injections; vendors differentiate via reliability, ready-to-administer formats, and customer service.

-

Regulatory Complexity: GMP enforcement, pharmacovigilance requirements, and controlled distribution of compounding components add cost and time-to-market.

-

Substitution by Alternative Agents: For specific procedures, agents like articaine (dentistry) or bupivacaine/ropivacaine (longer duration blocks) can limit share in those niches.

Segmentation

By Formulation/Route

-

Injectable solutions (with/without epinephrine; various concentrations) for local infiltration, field blocks, regional anesthesia, IV antiarrhythmics.

-

Topical semi-solids (creams, gels, ointments) for dermatology, minor procedures, and localized pain.

-

Topical sprays for mucosal anesthesia in ENT, dental, and endoscopic applications.

-

Transdermal patches for neuropathic and localized pain; valued for steady plasma levels and convenience.

-

Viscous and oral solutions for mucosal analgesia (e.g., stomatitis).

-

Ophthalmic preparations for surface anesthesia prior to ocular procedures.

By Indication

-

Local/regional anesthesia (surgical and dental)

-

Pain management (neuropathic, post-herpetic, musculoskeletal)

-

Aesthetic procedures

-

Antiarrhythmic therapy (acute care IV use)

By End User

-

Hospitals and ambulatory surgical centers

-

Dental clinics

-

Dermatology/aesthetic centers

-

Retail and online pharmacies (OTC/behind-the-counter topicals and patches)

Regional Insights

-

North America: High utilization driven by ambulatory surgery, aesthetics, and chronic pain management. Strong preference for ready-to-use, preservative-free injections and branded patches with payer coverage dynamics shaping adoption.

-

Europe: Mature generics market with robust pharmacovigilance; sustained demand in dentistry and dermatology. Country-specific reimbursement policies influence mix between branded and generic topicals.

-

Asia-Pacific: Fastest growth on the back of expanding healthcare access, dental procedure volumes, and aesthetic medicine adoption in urban centers. Local API production capacity is rising, improving supply resilience.

-

Latin America: Steady procedural growth; value segments favor cost-competitive generics while private clinics drive uptake of premium topicals in aesthetics.

-

Middle East & Africa: Increasing surgical capacity and dental services; distributor partnerships important for market entry and cold-chain integrity where required.

Technology and Product Trends

-

Buffered/alkalinized formulations reduce injection pain and accelerate onset, improving patient experience in office settings.

-

Combination products (e.g., with epinephrine for hemostasis or with prilocaine/tetracaine for enhanced topical effect) target procedure-specific needs.

-

Advanced transdermals employing multilayer matrices or permeation enhancers aim for longer wear times and consistent analgesia.

-

Extended-release injectables (encapsulation, depot systems) are being explored to bridge the duration gap with longer-acting anesthetics.

-

Ready-to-administer formats (pre-filled syringes, unit-dose vials) reduce medication errors and waste, supporting hospital pharmacy initiatives.

Regulatory and Quality Considerations

Regulators emphasize GMP compliance, sterility assurance for injectables, extractables/leachables control in packaging, and stringent bioequivalence for generics. Pharmacovigilance focuses on systemic toxicity events, methemoglobinemia risks in certain combinations, and misuse/overuse of OTC topicals. In some markets, compounding oversight has tightened, influencing how clinics source high-concentration topical anesthetics.

Competitive Landscape

The market contains a broad base of API producers and finished-dose manufacturers. Differentiation levers include:

-

Supply reliability and redundancy (dual API sources, multiple sites)

-

Portfolio breadth (complete range of concentrations and SKUs)

-

Quality and service (sterility track record, on-time delivery, shortages management)

-

Value-added formats (patches, pre-filled syringes, buffered kits)

-

Commercial reach (hospital tenders, GPO contracts, dental and aesthetic channel partnerships)

M&A and licensing are common to access technologies (e.g., enhanced patches) or expand geographic footprints. Strategic alliances with dermatology and dental distributors enhance last-mile access.

Pricing and Procurement Dynamics

Hospital tenders and group purchasing organizations exert strong price pressure on injections, making reliability and total cost of care (reduced wastage, fewer errors) key decision criteria. In retail, branded topical patches compete with private-label generics; payer coverage, step-edits, and patient co-pays shape mix. In dental and aesthetics, clinician preference and procedure throughput reward convenient, fast-onset products even at premium pricing.

Sustainability and ESG

Pharma supply chains increasingly report on solvent recovery, waste minimization, and energy use in API synthesis. Packaging optimization (lightweight vials, recyclable cartons) and reduction of cold-chain dependencies where feasible support sustainability targets. Ethical marketing and patient-safety education around proper dosing of OTC topicals are integral to social responsibility agendas.

Strategic Recommendations

-

De-risk supply with multi-sourced API and geographically diverse manufacturing; maintain qualified secondary suppliers.

-

Invest in format innovation—pre-filled, buffered, and combination kits tailored to dental and dermatology workflows.

-

Strengthen clinical education on dosing, toxicity prevention, and opioid-sparing protocols to align with hospital quality goals.

-

Target fast-growing channels such as office-based procedures and aesthetic clinics through specialized sales forces and sampling programs.

-

Differentiate through quality (low particulate, consistent potency) and service (shortage mitigation plans), not just price.

-

Leverage real-world evidence to demonstrate outcomes (faster onset, improved patient satisfaction, reduced rescue analgesic use) for premium formulations and patches.

Outlook

The lidocaine market should see steady, procedure-linked growth supported by the global pivot to minimally invasive care and durable demand for localized, non-opioid analgesia. While commodity injections face persistent price pressure, value will accrue to reliable suppliers and innovators offering patient-centric delivery systems and workflow-friendly formats. Companies that combine manufacturing resilience, regulatory excellence, and channel-specific product design will be best positioned to capture share across hospital, dental, dermatology, and retail settings.