Internal Accounting Services: Managing QuickBooks Payroll Efficiently

Internal Accounting Services

Internal accounting services play a pivotal role in ensuring that QuickBooks Payroll runs smoothly, accurately, and in compliance with regulations. When managed effectively, payroll ceases to be just another administrative task—it becomes a strategic function that supports business growth, employee satisfaction, and financial clarity.

In today’s competitive landscape, businesses that leverage QuickBooks Payroll alongside strong internal accounting processes can cut errors, reduce costs, and stay compliant while also freeing up time for more value-driven tasks.

Why Efficient Payroll Management Matters

Efficient payroll is not simply about ensuring employees get paid on time—it’s about:

-

Compliance: Avoiding costly legal penalties from payroll tax errors.

-

Employee Trust: Building morale by ensuring accurate, timely payments.

-

Resource Optimization: Minimizing time spent on repetitive data entry through automation.

-

Informed Decision-Making: Using payroll data for budgeting and forecasting.

A well-managed payroll system safeguards your business finances and keeps employees satisfied—two essentials for long-term success.

Setting Up QuickBooks Payroll for Success

Efficient payroll starts with a correct, tailored setup. Internal accounting teams should focus on the following:

1. Accurate Data Entry

-

Complete company details like legal name, Employer Identification Number (EIN), and tax information.

-

Precisely enter all employee records, including tax forms (W-4 for employees, W-9 for contractors).

-

Define pay schedules (weekly, bi-weekly, semi-monthly, or monthly) to align with business needs.

Pro tip: Double-check all entries before the first payroll run to avoid messy corrections later.

2. Customized Chart of Accounts

QuickBooks Payroll allows customization of the chart of accounts to:

-

Track payroll expenses by department or project.

-

Monitor payroll liabilities like taxes, benefits, and deductions.

-

Produce detailed expense reports for smarter financial planning.

Automation: The Backbone of Payroll Efficiency

QuickBooks Payroll offers powerful automation features that save time and reduce errors:

-

Automated Salary Processing: Recurring payments for salaried employees.

-

Direct Deposit: Quick, paperless payments to employees’ bank accounts.

-

Automated Tax Calculations & Filings: Ensures correct withholdings, deductions, and timely submissions.

-

Integrated Time Tracking: Track hours and overtime automatically with QuickBooks Time.

By maximizing automation, internal accounting services can significantly lighten their payroll workload.

Staying Compliant with Payroll Laws

Payroll is among the most regulated areas of finance. To avoid penalties:

-

Keep QuickBooks tax tables updated.

-

Accurately classify workers as employees or contractors.

-

Set correct payroll types (hourly, salaried, commission-based).

-

Generate and file year-end forms like W-2 and 1099 on time.

Internal accounting teams should conduct regular compliance audits and stay informed about both federal and state-level changes.

Best Practices for Internal Accounting Teams

Data Management

-

Update wage rates and deduction info in real-time.

-

Securely archive payroll reports, tax filings, and employee forms.

-

Limit payroll access to authorized personnel only.

Streamlining Operations

-

Automate recurring payments for fixed-salary employees.

-

Use QuickBooks’ custom reporting to aid budgeting and audits.

-

Sync payroll with the general ledger for a unified financial overview.

Employee Self-Service for Transparency

QuickBooks Payroll offers self-service portals, allowing employees to:

-

Access pay stubs instantly.

-

Download tax documents like W-2 and 1099 without HR assistance.

This transparency promotes trust and reduces administrative queries.

Security, Auditing, and Controls

Internal accounting services should:

-

Maintain audit trails for every payroll change.

-

Regularly review access permissions.

-

Verify that automated filings and payments are completed as scheduled.

Robust security measures protect both the company and employees from data breaches.

Managing Complex Payroll Scenarios

Some payroll cases require extra attention:

-

Deductions for health insurance, retirement, or garnishments.

-

Variable pay elements like bonuses and overtime.

-

Contractor or part-time arrangements, ensuring proper classification.

Clear documentation and timely updates in QuickBooks prevent miscalculations.

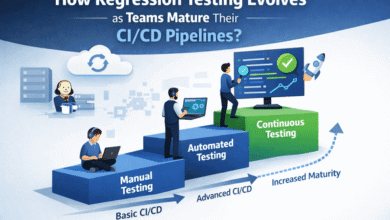

Continuous Improvement: The Path to Payroll Excellence

Payroll processes should evolve alongside business needs:

-

Gather regular feedback from employees and management.

-

Explore new QuickBooks features that enhance efficiency.

-

Provide ongoing training to payroll staff for improved system use.

Continuous improvement ensures payroll remains accurate, compliant, and aligned with business goals.

Payroll & Financial Integration Benefits

QuickBooks allows payroll data to be fully integrated into overall financial management:

-

Verify budget accuracy by analyzing payroll against revenue.

-

Track project or job labor costs for profitability analysis.

-

Use payroll trends to predict cash flow requirements.

This integration turns payroll data into a strategic decision-making tool.

Internal Payroll vs Outsourcing

While outsourcing is common, handling payroll internally with QuickBooks offers:

-

Real-time control over payroll changes.

-

Lower costs compared to third-party providers.

-

Full customization of reports, workflows, and schedules.

However, internal management requires the right expertise and dedicated resources.

Avoiding Common Payroll Pitfalls

-

Data Entry Mistakes: Double-check new employee setups and pay changes.

-

Ignored Updates: Always update QuickBooks for tax rate and compliance changes.

-

Poor Record-Keeping: Archive payroll files securely.

-

Lack of Communication: Keep employees informed about schedule changes, deductions, or benefit adjustments.

The Future of Payroll with QuickBooks

QuickBooks Payroll is advancing with features like:

-

AI-powered payroll predictions to forecast labor costs.

-

Enhanced data encryption for security.

-

Automatic legal updates for compliance without manual tracking.

Embracing these features will keep payroll precise and future-ready.

Final Thoughts

When handled by a skilled internal accounting team, QuickBooks Payroll becomes more than a tool—it becomes a strategic asset. Success depends on:

-

Flawless setup and configuration.

-

Smart automation to reduce manual work.

-

Ongoing compliance and security checks.

-

Transparency with employees.

-

Continuous process improvement.

By mastering these practices, businesses can turn payroll from a basic necessity into a competitive advantage.

Also Visit : https://theglobalnewz.com/