Top Features to Look For in a Secure Cash App Clone

The digital payment landscape has evolved rapidly, with peer-to-peer payment solutions becoming essential for users worldwide. A Cash App Clone offers businesses an opportunity to launch a ready-to-deploy solution tailored to facilitate secure and swift online money transfers. However, not all clones are equal when it comes to functionality and security. Whether you are a fintech startup or an established brand entering the digital payments industry, identifying the key features in a secure Cash App Clone is critical to success.

Below are the most important features and functionalities that should be part of a secure and efficient Cash App Clone for your business.

User-friendly registration with advanced authentication

A smooth and user-friendly registration process enhances user adoption. However, security should never be compromised for ease. The sign-up flow should allow users to register using their mobile number or email ID. To protect user data and prevent unauthorized access, two-factor authentication and biometric verification should be implemented. This helps validate genuine users and adds an additional security layer during login and transactions.

End-to-end encryption for all transaction data

Encryption plays a central role in building trust with users. Every Cash App Clone must have end-to-end encryption protocols to secure the transaction data, user information, and payment credentials. Implementing 256-bit SSL encryption ensures that any data transferred between users and the server is unreadable by hackers. This feature is critical to protect user privacy and prevent data theft in digital payment apps.

Instant money transfers with real-time processing

A vital feature of any successful peer-to-peer payment platform is instant transaction capability. Users expect quick and seamless money transfers between accounts, especially in urgent situations. A robust backend architecture that processes payments in real-time will improve user experience and trust. It also minimizes pending transactions and delays that often frustrate users in less optimized apps.

Fraud detection mechanisms and suspicious activity alerts

Security threats such as unauthorized access, identity theft, and phishing scams are common in financial platforms. A Cash App Clone must be built with a fraud detection engine that monitors transaction patterns and flags unusual activities. When suspicious activity is detected, the system should immediately alert users and lock transactions until verification. These features reduce financial risk and provide a strong safeguard for user accounts.

Multi-platform accessibility across Android and iOS

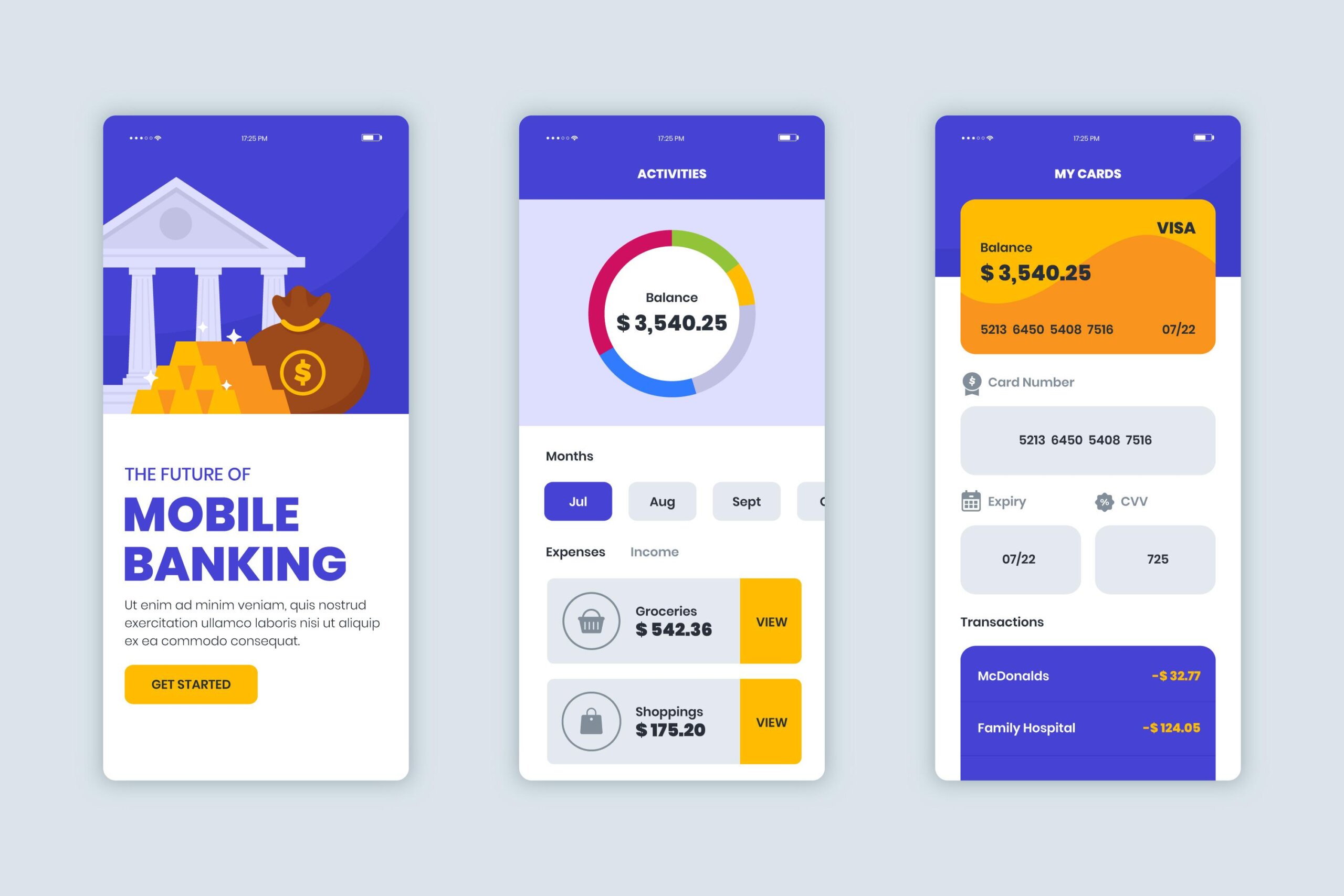

Accessibility is a cornerstone of a successful Cash App Clone. Your app must be compatible with both Android and iOS operating systems. A hybrid or native app design can offer users a smooth experience regardless of the device they use. In addition, mobile responsiveness and a clean user interface ensure that the app is usable by people from different age groups and technical backgrounds.

Integration of digital wallets and linked bank accounts

To enhance usability and convenience, the app must support linking to bank accounts and popular digital wallets. This feature allows users to add funds, withdraw balances, and perform transactions without switching platforms. A seamless integration with banks also enables KYC verification and improves transaction legitimacy. Users should be able to manage their wallets, check transaction history, and control spending directly within the app interface.

QR code scanner and contact-based money transfers

For users who want to send or receive money quickly, features like QR code scanning and contact list integration are crucial. With QR codes, users can instantly pay or receive funds in physical stores, restaurants, or among friends without manually entering account details. Integration with phone contact lists simplifies money transfers by allowing users to send funds to anyone in their phonebook who is also using the app.

Push notifications for updates and transaction history

Real-time updates via push notifications are necessary to keep users informed about their account activities. From payment confirmations and account changes to suspicious login attempts, notifications provide immediate updates that help users stay in control. Additionally, access to a comprehensive transaction history helps users track their spending patterns and manage personal finances effectively.

Admin dashboard for user management and compliance

An efficient admin dashboard is essential for managing users, monitoring transactions, generating reports, and handling compliance requirements. It provides the app administrators with real-time access to data insights and platform performance. Features like user verification tools, transaction controls, and support ticket resolution are necessary to ensure smooth backend operations and regulatory compliance.

Regulatory compliance and KYC verification features

Adherence to financial regulations is mandatory for operating a peer-to-peer payment platform. A Cash App Clone must have built-in features to support Know Your Customer (KYC) processes. This includes document verification, user identification, and automated compliance checks. KYC helps prevent the misuse of the app for illegal activities and builds credibility with users and partners.

Scalability to support growing user base and transactions

As your user base grows, the app should scale without performance issues. The backend system should be designed to handle increasing transaction volumes, multiple payment requests, and new feature additions. A scalable architecture ensures that the app continues to perform well during peak usage and doesn’t slow down, crash, or risk data loss.

Data backup and disaster recovery systems

Data security goes beyond encryption. The app must have automatic data backup systems and disaster recovery protocols in place. These features ensure that critical user and transaction data can be recovered in case of unexpected failures or cyberattacks. Regular backups and secure cloud storage solutions play a key role in long-term data management and user trust.

Customer support chat and in-app help center

A secure and user-friendly payment app should offer accessible support options. An in-app help center that includes FAQs, live chat, and support ticket generation helps users resolve issues without leaving the app. 24×7 support, either via automated bots or human agents, adds value to the customer experience and boosts app ratings and retention.

Customizable UI and branded theme options

While security is paramount, visual appeal and branding also matter. A Cash App Clone should be easily customizable with colors, fonts, themes, and logo options to match your brand identity. A well-designed user interface contributes to trust, makes the app more intuitive, and ensures users feel confident using the platform for financial transactions.

Why businesses should consider a Cash App Clone

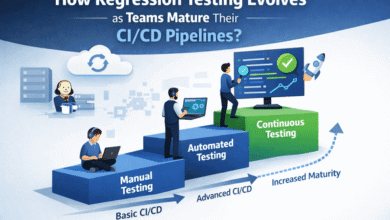

Building a peer-to-peer payments app from scratch can be time-consuming and expensive. A Cash App Clone provides a ready-made framework that can be customized to meet your business requirements quickly. It reduces time-to-market and helps launch a secure and reliable payment solution without major development hurdles. When partnered with experienced Mobile App Development services, businesses can ensure their clone is modern, compliant, and user-focused.

The future of digital payments and secure clone apps

As user expectations rise and cyber threats become more sophisticated, only those apps that combine innovation with security will thrive. For businesses investing in p2p money transfer app development, adding the features listed above ensures that the final product stands out in the crowded fintech market. Security is no longer optional; it is the foundation upon which trust and success are built.

Conclusion

In conclusion, choosing or building a Cash App Clone with robust features, stringent security measures, and user-centric design is crucial for long-term success in the digital payments industry. By prioritizing encryption, real-time transactions, fraud protection, and compliance, you can deliver a solution that is not only functional but also trusted by users.

If you are ready to explore secure mobile payment solutions for your business, focusing on these features will set you on the right path to success.